In this new Guide to Big Data for Finance the goal is to provide direction for enterprise thought leaders on ways of leveraging big data technologies in support of analytics proficiencies designed to work more independently and effectively in today’s climate of working to increase the value of corporate data assets.

This article is the first in a series that explores the benefits the financial services community can achieve by adopting big data technologies. The complete insideBIGDATA Guide to Big Data for Finance is available for download from the insideBIGDATA White Paper Library.

Introduction to Big Data for Finance

Introduction to Big Data for Finance

According to the 2014 IDG Enterprise Big Data research report, companies are intensifying their efforts to derive value through big data initiatives with nearly half (49%) of respondents already implementing big data projects or in the process of doing so in the future. Further, organizations are seeing exponential growth in the amount of data managed with an expected increase of 76% within the next 12-18 months. With growth there are opportunities as well as challenges. Among those facing the big data challenge are finance executives, as this extraordinary growth presents a unique opportunity to leverage data assets like never before.

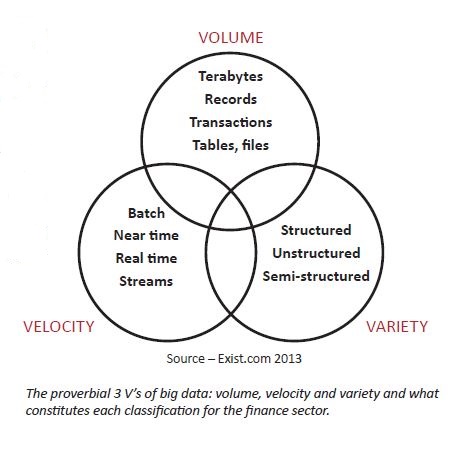

As the 3 V’s of big data: volume, velocity and variety continue to grow, so too does the opportunity for finance sector firms to capitalize on this data for strategic advantage. Finance professionals are accomplished in collecting, analyzing and benchmarking data, so they are in a unique position to provide a new and critical service—making big data more manageable while condensing vast amounts of information into actionable

business insights.

Although many perceive a financial industry mindset that’s wary of change—it is the cautious adoption of big data technologies such as cloud

Although many perceive a financial industry mindset that’s wary of change—it is the cautious adoption of big data technologies such as cloud

solutions and Hadoop using the open source distribution model that will be transformative in many fundamental ways. Further, financial services firms that use business analytics efficiently and effectually will thrive in the current uncertain and fluctuating markets, while those that do not are likely to founder.

Financial services firms are discovering many innovative and strategic directions by consolidating data traditionally managed in departmental silos in order to more holistically analyze risk exposure, comply with regulatory mandates, and perform enterprise-level analytics. Traditional technologies such as relational database management systems make it challenging, many times impossible, to process growing volumes of data and make them accessible, actionable and elastic to changing requirements in terms of advanced analytics. Big data solutions that support evolving business and regulatory requirements by maintaining a network of growing data stores will become invaluable in their ability to be used for multiple purposes and to answer any query months or years from now.

In a recent research report, SunGard has identified ten trends shaping big data initiatives across all segments of the financial services industry:

In a recent research report, SunGard has identified ten trends shaping big data initiatives across all segments of the financial services industry:

- Larger market data sets containing historical data over longer time periods and increased granularity are required to feed predictive models, forecasts and trading impacts throughout the day.

- New regulatory and compliance requirements are placing greater emphasis on governance and risk reporting, driving the need for deeper and more transparent analyses across global organizations.

- Financial institutions are ramping up their enterprise risk management frameworks, which rely on master data management strategies to help improve enterprise transparency, auditability and executive oversight of risk.

- Financial services companies are looking to leverage large amounts of consumer data across multiple service delivery channels (branch, web, mobile) to support new predictive analysis models in discovering consumer behavior patterns and increase conversion rates.

- In post-emergent markets like Brazil, China and India, economic and business growth opportunities are outpacing Europe and America as significant investments are made in local and cloud-based data infrastructures.

- Advances in big data storage and processing frameworks will help financial services firms unlock the value of data in their operations departments in order to help reduce the cost of doing business and discover new arbitrage opportunities.

- Population of centralized data warehouse systems will require traditional ETL processes to be re-engineered with big data frameworks to handle growing volumes of information.

- Predictive credit risk models that tap into large amounts of data consisting of historical payment behavior are being adopted in consumer and commercial collections practices to help prioritize collections activities by determining the propensity for delinquency or payment.

- Mobile applications and internet-connected devices such as tablets and smartphone are creating greater pressure on the ability of technology infrastructures and networks to consume, index and integrate structured and unstructured data from a variety of sources.

- Big data initiatives are driving increased demand for algorithms to process data, as well as emphasizing challenges around data security and access control, and minimizing impact on existing systems.

Big data is an emergent trend driving investments in enterprise analytics, and correspondingly, analytic excellence is central to much needed innovation in today’s financial services marketplace. Business analytics applied to capital management, regulatory compliance, corporate performance, trade execution, security, fraud management, and other instrumental disciplines is the principal innovation platform to improving strategic decision making. Analytics and the ability to efficiently and effectively exploit the big data technology stack, advanced statistical modeling, and predictive analytics in support of real-time decision making across business channels and operations will distinguish those companies that flourish in uncertain markets from those that misstep.

Over the next few weeks we will explore these Big Data for Finance topics:

- Introduction to big data for finance

- Retail banking

- Credit scoring and back trading/testing

- Adopting big data for finance

- Security and regulatory compliance considerations

If you prefer the complete insideBIGDATA Guide to Big Data for Finance is available for download in PDF from the insideBIGDATA White Paper Library, courtesy of Dell and Intel.

Speak Your Mind