I recently caught up with Bill Waid, VP and General Manager of FICO Decision Management Suite to discuss FICO’s long and deep history with AI and machine learning in the solution of business problems, most notably fraud detection. Bill also outlines the evolution of the company’s use of this technology with its cloud enabled platform that combines analytics, decisions, and optimization into a Decision Management Suite (DMS). Bill is vice president and general manager of FICO Decision Management, which builds and delivers predictive analytics, decisioning and optimization solutions. Prior to joining FICO in 2002, he held various leadership roles at HNC Software, Brokat Solutions, Blaze Software, Neuron Data, and Stone & Webster.

I recently caught up with Bill Waid, VP and General Manager of FICO Decision Management Suite to discuss FICO’s long and deep history with AI and machine learning in the solution of business problems, most notably fraud detection. Bill also outlines the evolution of the company’s use of this technology with its cloud enabled platform that combines analytics, decisions, and optimization into a Decision Management Suite (DMS). Bill is vice president and general manager of FICO Decision Management, which builds and delivers predictive analytics, decisioning and optimization solutions. Prior to joining FICO in 2002, he held various leadership roles at HNC Software, Brokat Solutions, Blaze Software, Neuron Data, and Stone & Webster.

insideBIGDATA: Please give us a rundown of your work at FICO and a peek at the products you oversee.

Bill Waid: Since 1956 FICO has been in the business of operationalizing analytics and decisioning. Initially applied to off-shore oil exploration, the application of these advanced analytic techniques gravitated to software solutions for the financial services industry, such as customer management and the use of artificial intelligence (AI) and machine learning (ML) to detect fraud. Today, FICO software solutions are used across most major industries and in more than 100 countries. We do everything from protecting 2.6 billion payment cards from fraud, to helping people get credit, to ensuring that millions of airplanes and rental cars are in the right place at the right time.

There is much talk, and investment, focused on unlocking the value of Big Data through advanced analytics. Yet, the common struggle is realizing that value in an actionable business application that can:

- be achieved in a timely manner,

- enable the business operation,

- evolve with changing demands, and

- reduce the dependency on scarce technical resources.

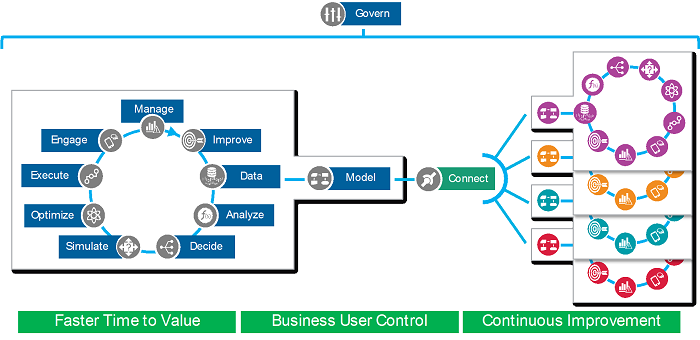

FICO has built a Cloud enabled platform that combines analytics, decisions, and optimization into a Decision Management Suite (DMS). DMS enables the formation, deployment, and continuous improvement of analytically driven solutions. These solutions deliver high impact value in a matter of months without the investment in an army of scarce data scientists and technical skilled staff.

I’m fortunate to spend most of my time partnering with our clients to innovate on solutions that will address their most pressing business challenges. By applying relevant advance analytics with proven decisioning techniques and simulating predictive outcomes, we are able to help our clients in their digital transformation.

insideBIGDATA: Can you give our readers a high level view of how FICO has been developing and operationalizing machine learning over the years?

Bill Waid: In 1992, FICO pioneered the use of ML and AI to detect credit card fraud with some astonishing, and even market changing results, saving businesses hundreds of millions in fraud losses annually. Over the years FICO has been awarded more than 185 patents as we expanded our core AI/ML capabilities to become self-calibrating and inclusive of alternative data sources (a now common theme for your readers, but applied more than two decades ago).

What is interesting about this well-known and often referenced use of AI/ML, is the potential opportunity cost. Despite the significant savings realized, the impact of declining a customer transaction that was not fraudulent leads to and even more costly unsatisfactory customer engagement and eventual attrition. To operationalize this AI/ML solution and fully realize the value, decisioning and a continuous improvement feedback loop was required.

Capitalizing on the power of AI/ML, FICO has expanded both the algorithms and application of AI/ML to a broad set of solutions since 1992. Most notable is the use of ML to find predictive patterns in the ever-expanding Data Lakes our clients are collecting and using those ML findings to augment existing decisions and incrementally improve business outcomes. By deploying ML models in a way that the decision outcome could be managed and monitored to ensure accuracy, business owners could learn from the ML model and gain confidence that the model was indeed providing tangible improvement.

This last innovation was a natural evolution to what FICO refers to as explainable AI (xAI). Both for assurance that business outcomes left in the hands of AI/ML models were understandable and auditable, explain-ability is often a regulatory requirement in much of the business employing such models. This lead to the FICO innovation where a AI/ML model can continuously improve from expanding data sources while still offering transparency into why and how the model came to the conclusion it did.

insideBIGDATA: Can you outline some strategies for creating a dynamic, data-driven customer life-cycle from data ingestion through execution, measurement and adaptation? How do you suggest improving decisioning with real-time customer engagement and actionable insights?

Bill Waid: Over the past two decades FICO has perfected something we refer to as Adaptive Control in most aspects of the customer life-cycle. This technique has been employed in all FICO solutions through the Decision Management Platform:

Foundational to the approach is the need to work on federated data, exploiting the breadth of available data within the current state of the enterprise (a topic worthy of its own discussion).

From this point, analysis, modeling, and actioning through decisioning is combined, essentially connecting them in the processes. Capturing the data passing through this process into what we refer to as an Analytic Data Mart (ADM) permits individuals to simulate decision and analytics to assess the business impact. Through straight-forward business reports, outcomes can be determined before live deployment.

On the surface this sounds rather simple, yet the management and governance of these elements can get complicated. Linked directly to the execution, this closed loop process permits business owners to understand outcomes, manage change and continuously improve in a fraction of the time traditional approaches require. However, the most important requirement is the direct involvement and enablement of the business stakeholder.

Within a singular customer touchpoint this can often be manageable; but, when addressing the full customer life-cycle the connection of consistent action, an understanding of how that action was arrived at and how to improve it, requires a centralized decision capability. This centralized decisioning capability results in a faster time-to-market, consistent customer engagement (and at a greater scale), and the ability to measure business outcomes and simulate alternative strategies for continuous improvement. Accomplishing this requires more than just a common execution platform or technology standard.

Historically FICO has applied this capability to real-time customer interactions, but the growing area of interest is to apply consistent customer actions across the full customer engagement. This necessitates the need to infer customer events and add to the decision process by ingesting substantially more (if not all available) customer data, both internal and external, to provide an improved customer experience. Accomplishing this requires new capabilities, such as customer identity resolution, customer profiling, event correlation, and even sentiment analysis. What better area than this to apply AI/ML capabilities?

insideBIGDATA: What are the latest scorecard development techniques that make it even faster and easier to develop powerful predictive models?

Bill Waid: The use of scorecards is foundational to the history of FICO from the very initial days in 1956. While an older technique for building advanced analytics, to this day it still affords one of the most valuable capabilities for business applications – it’s easy to understand and explain. The challenge is the development of scorecards depends on a data scientist that has an intimate and deep understanding of the data and by that very nature tends to evolve slowly with the introduction of new data sources.

Combining ML and scorecards offers the best of both worlds. ML models can quickly assimilate new data, as well as evolve dynamically when there are changes in the data, avoiding model refresh and stale predictors.

FICO has introduced a new ML capability that can be translated into a scorecard, providing the benefits of scorecard usability with the predictive power of ML. This proprietary technique has opened doors for less qualified individuals to build ever greater predictive scorecards that are applied in regulated and constrained fields.

insideBIGDATA: What’s in store for the future with machine learning and AI at FICO?

Bill Waid: AI/ML provide incredible opportunities for continually expanding the field of analytics, and what truly sets FICO apart is the vision to enable organizations to operationalize their analytics and optimize their existing investments. Yet, AI can be intimidating and is sometimes referred to as a “black box” of sorts, with many unanswered questions like, “Why does one algorithm work while the other one doesn’t?” ML’s most powerful value is that it becomes more accurate, more robust, future proof overtime as it learns from each interaction.

Business leaders want to explore alternative possibilities and investigate the business outcomes of their investments, but today there is uncertainty in leveraging AI/ML models to accomplish this. Explainable AI affords the next key step in the evolution of more sophisticated applications. The future can be unlocked if AI/ML are injected into current business processes to enrich outcomes. We see an eventual state where AI/ML models can replace the traditional advanced analytics process and become adaptive as businesses evolve, provided these models can be governed and directed by human interaction.

Today FICO provides an analytic data mart (ADM) and creates reports detailing exactly how a model arrives at a particular decision and how it went through each step of a decision-making process. FICO is governed by regulation and motivated to provide business value, which is why there is always an explanation as to why a decision was made. Powerful capabilities from within the ADM offer a unique and significant business-outcome simulation feature. Proposed changes can be evaluated using the performance data of the ADM to compare before and after outcomes, as well as “what-if” scenarios. By narrowing down to just those modified outcomes and then visually presenting associated outcomes, the business stakeholder is able to assess, approve, modify and proceed in record time.

Sign up for the free insideBIGDATA newsletter.

Speak Your Mind